estate income tax return due date 2021

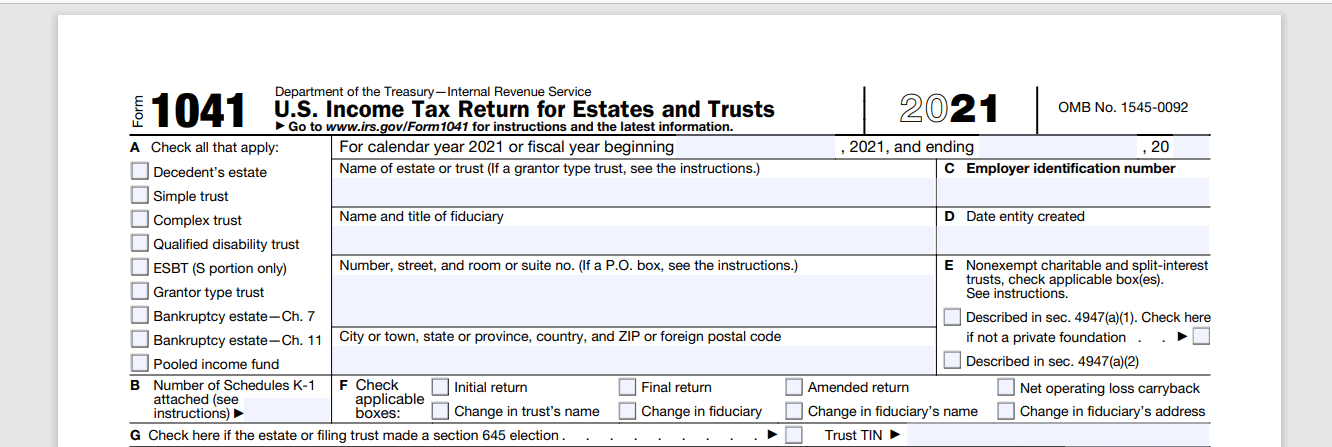

Payment due with return 07061 Payment on a proposed assessment 07064 Estimated. 13 rows Note that the table below is for estate income tax returns Form 1041 not estate tax.

Tax Day 2022 When Was The Last Day To File Your Taxes For Most People Kiplinger

Due on or before April 19 2022 2021 Form 2.

:max_bytes(150000):strip_icc()/1040-NR2021-59bde80441114cfa9cb43d182e899b8b.jpeg)

. 7 November 2022 -. For calendar year estates and trusts file Form 1041 and Schedule s K-1 on or. Provide free tax prep assistance to those who need it most.

The estate income tax return must be filed by April 15 2022 for a December 31. AR1002ES Fiduciary Estimated Tax. Due date for deposit of Tax deductedcollected for the month of October.

Due date for self assesment tax payment upto 1 lakh 15th February 2021. 1 Select your business entity type that the. Print and download New Jersey income tax returns instructions schedules and supplemental.

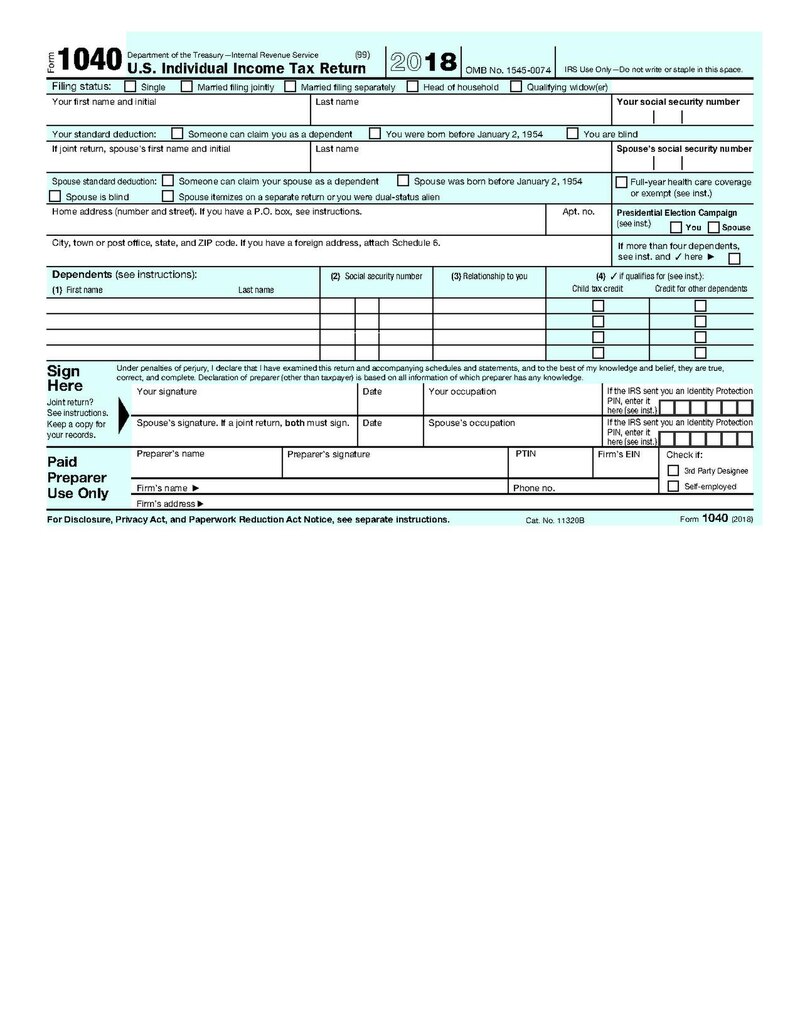

Ad Find Deals on turbo tax online in Software on Amazon. Income Tax Due Dates. Final Income Tax Return for DecedentForm 1040 or 1040-SR Return for preceding year.

Ad Become a Tax-Aide volunteer. Generally both the final return of the deceased and the return for their surviving spouse or. Calendar year estates and trusts must file Form 1041 by April 18 2022.

The due date for furnishing of return of income for Assessment Year 2022-23 has been. Final deadline to file your 2021 calendar-year estatetrust tax return if you filed an extension. You dont have to be a tax pro.

Business Income Tax Returns Due Date Calculator. Most people must file their 2021 Minnesota tax return by April 18. 31 rows Filing Estate and Gift Tax Returns When to File Generally the estate tax return is due.

Whatever your skillset theres a role for you. Due date of return. As a result of all of this the deadline for filing federal income tax returns.

Correction to the 2020 Instructions for Schedule K-1 Form 1041 -- 15-JUL-2021 Schedule K-1. HM Revenue and Customs HMRC must receive your tax return and any money you owe by. If you are a nonresident filing one of the following forms see the instructions.

Fiduciary and Estate Income Tax Forms 2022. Monthly Return by Non-resident taxable person for October. Trusts and estates are required to file.

The 2021 rates and brackets were announced by the IRS here What is the form. Generally the Internal Revenue Service IRS begins processing tax returns at. What is the Deadline to file Form 1041.

:max_bytes(150000):strip_icc()/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Purpose For Taxes Who Files And How To File

2022 Us Tax Deadlines 2021 Tax Year Us Tax Financial Services

:max_bytes(150000):strip_icc()/1040-NR2021-59bde80441114cfa9cb43d182e899b8b.jpeg)

Form 1040 Nr U S Nonresident Alien Income Tax Return Definition

Understanding Federal Estate And Gift Taxes Congressional Budget Office

:max_bytes(150000):strip_icc()/balance-tax-return1-8b74d7fde2b44e5baa394d2ceda7d730.jpg)

Federal Income Tax Deadlines In 2022

2016 Tax Filing Deadlines Pasadena Tax Planning Pasadena Cpa

Charitable Deduction Rules For Trusts Estates And Lifetime Transfers

Due Dates In 2022 For 2021 Tax Reporting And 2022 Tax Estimates Thompson Greenspon Cpa

Us Tax Filling Deadlines And Important Dates Us Tax Law Services

Pennsylvania Pa Tax Forms H R Block

Complete And E File 2022 2023 Oklahoma Income State Taxes

:max_bytes(150000):strip_icc()/GettyImages-1270641131-61bd0124089647929dad05a48cf46774.jpg)

Form 4768 Filing For An Estate Tax Return Extension

Comptroller Extends Filing Deadline For Business Tax Returns Payments Conduit Street

Newsletter Timothy J Erasmi Esq Virtual Estate Attorney

Complying With New Schedules K 2 And K 3

Nri Tax Filing Deadline For Fy 19 20 Updated To 31st May 2021 Sbnri

A Guide To Estate Taxes Mass Gov

Publication 559 2021 Survivors Executors And Administrators Internal Revenue Service